APRIL 2 On 25 November 2013 at the opening of National Economic Empowerment PENA Conference Datuk Seri Najib Razak publicly proclaimed tax evasion as tantamount to an act of treason that have betrayed the country. Common tax offences that could get you into trouble.

Pdf Estimating Factors Affecting Tax Evasion In Malaysia A Neural Network Method Analysis Semantic Scholar

Investigated the phenomena of tax evasion for Malaysia.

. The subject of taxes was discussed in the. Not filing your taxes. 2000 estimated the size of hidden income and tax evasion for Malaysia.

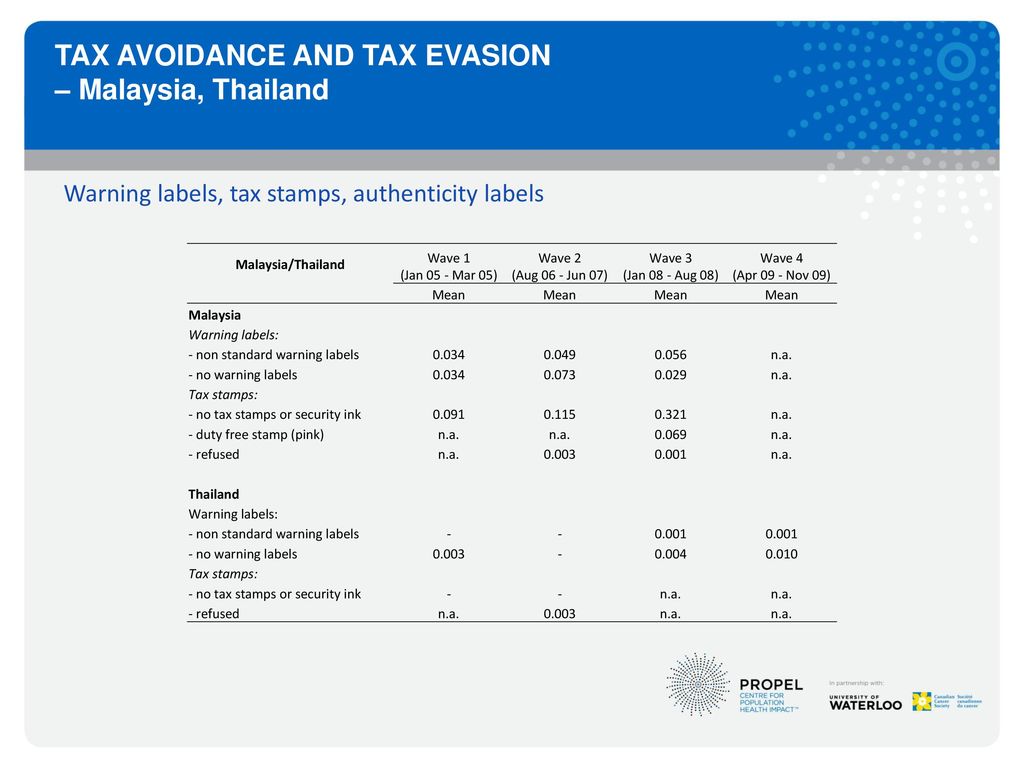

An artificial neural network method analysis January 2013 Jurnal Ekonomi Malaysia 47199-108. When tax evasion is seen as unacceptable taxpayers will tend to evade tax less. In another study Kasipillai et al.

Among these studies we can point to the study of Kasipillai et al. Using a false identity for tax purposes. Tax investigation involves the inspection of the business of the taxpayer as well as individual books.

Information required of tax evader. Tax crimes in Malaysia. Although tax avoidance is acceptable in the eyes of law in Malaysia the tax authority taken an extreme change of stance since 2010 and triggered Section 140 of the Malaysia Income Tax Act more often that it does historically.

Just like many other countries Malaysia does have tax investigation. 2003 that investigated the influence of education on tax avoidance and tax evasion by using questioner method. Tax offences such as non-compliance and tax evasion will be charged under the Income Tax Act.

The European Union EU has added Malaysia to its Annex II grey list of non-cooperative nations for tax evasion for the first time. We are committed to targeting tax evasion and YOU can help us to make sure everyone pays their fair share of tax. Tax offences such as non-compliance and tax evasion will be dealt with in accordance with the provisions of the Income Tax Act 1967 Act 53 ITA and other acts administered by the Inland Revenue Board of Malaysia IRBM such as Real Property Gains Tax Act 1976 Act 169 Petroleum Income Tax Act 1967 Act 543 Promotion of.

As per Income Tax Act ITA 1967 any person who committed for an offence will be fine either through penalty of imprisonment or both depending on severity or the number of offences. The commentary covers the determination of a real property company release of Bumiputra quota the director. Fail to furnish an Income Tax Return Form.

Bahagian Perisikan Jabatan Perisikan Dan Profiling Lembaga Hasil Dalam Negeri Malaysia Level 3 Menara 2 No. This study is intended to examine the relationships between certain company attributes namely company ownership structure the size of company and the frequency of tax. Causes of tax evasion and their relative contribution in malaysia.

The success of self-assessment tax system is voluntary compliance with the tax laws. Section 114 1A makes it an offence for a person to advise another person on tax if it. Failure to file an income tax return.

If a friend or family member is asking you for tax advice that youre not sure of the answers to you might want to just direct them to the LHDN or a qualified professional if their taxes are complex. IRB says it found elements of tax evasion amounting to RM200m by firms receiving cooking oil subsidies IRB chief executive officer Datuk Mohd Nizom Sairi said the IRB conducted a three-day subsidised cooking oil operation code named Op Saji beginning March 21 to conduct tax investigations into 63 companies targeting subsidised cooking oil. The following table is the summary of the offences fines penalties for each offence.

3 Jalan 910 Seksyen 9 43650 Bandar Baru Bangi Selangor. Unlike tax evasion it is a criminal activity that is strictly prohibited under the Malaysia laws. Giving people bad tax advice.

If you dont you could be fined between RM200 to RM20000 imprisoned or both. If you earn enough to be taxed as of 2015 this means earning an annual income of RM34000 after EPF deduction you need to file your taxes. School of Economics MALAYSIA.

The purpose of this paper is to tackle one of the issues in tax evasion that is from the perspective of fraudulent financial reporting amongst small and medium-sized enterprises SMEs in Malaysia. False reporting of income. In the case of detection of tax offences such as fraud wilful defraud or.

This means that person or business entity avoids paying the full amount of tax that is owed to the government by dishonestly filing a tax return. This follows the earlier 2020 review of the top 5 tax cases. In a lengthy Facebook post today former prime minister Najib Abdul Razak warned of more tax evasion and other illicit economic activity once the sales and services tax SST is.

Hence the understanding of taxpayers attitude on tax morality towards a tax system has to be enhanced to minimize tax evasion cases. Tax evasion is also known as tax fraud. Due to under-reporting sales over.

Siong Sie returns with his review of the top 5 tax cases in Malaysia in 2021. According to Mohamad 2016 in 2011 the Inland Revenue Board of Malaysia IRBM had investigated about 9815 tax audit cases related to tax evasion by SMEs. Youll also have to make sure file your.

It occurs when an individual or a business entity intentionally falsifies tax return information to limit the tax liability amount. He emphasised paying taxes was a testament of ones patriotism necessary for the development of the countrys. The purposes of this study are to examine the relationship.

Our guest writer Khong Siong Sie writes on the top 5 tax cases in Malaysia for the year 2021. Refusing to pay taxes. Some examples of tax fraud which may take place in Malaysia are.

Claiming personal expenses as business expenses for the purposes of.

Pdf Causes Of Tax Evasion And Their Relative Contribution In Malaysia An Artificial Neural Network Method Analysis

Pdf Issues Challenges And Problems With Tax Evasion The Institutional Factors Approach

Estimating International Tax Evasion By Individuals

Pdf Cash Economy Tax Evasion Amongst Smes In Malaysia

Pdf Causes Of Tax Evasion And Their Relative Contribution In Malaysia An Artificialneural Network Method Analysis Semantic Scholar

The State Of Tax Justice 2021 Eutax

Pdf The Influence Of Education On Tax Avoidance And Tax Evasion

Tax Avoidance And Tax Evasion In 14 Itc Countries Ppt Download

5 Common Malaysian Tax Offences You Don T Want To Asklegal My

Pdf Factors Affecting Tax Compliance Behaviour In Self Assessment System

Wkisea Treading The Fine Line Between Tax Planning And Tax Avoidance

Estimating International Tax Evasion By Individuals

Businessman Jailed Tax Evasion Screenshot From The Sun Daily Cilisos Current Issues Tambah Pedas

Penalties For Income Tax Evasion And Offences In Malaysia

Malaysian Tax Revenue Goes Up In Smoke From Illegal Cigarette Sales Wsj

Global Distribution Of Revenue Loss From Tax Avoidance Re Estimation And Country Results Eutax

Is Tax Avoidance Legal In Malaysia